- #Business credit score check for free#

- #Business credit score check how to#

- #Business credit score check free#

It furnishes you with your business’s credit score, banking and leasing information, bankruptcies (if there are any) and other key elements of its credit profile. The least expensive way to check your business credit score and credit profile from Experian is to buy its CreditScore Report, which would cost you $39.95 for one-time access. Knowing where you stand can help you take steps to lift up your score, such as asking suppliers to furnish D&B with your payment performance history so that your application doesn’t get denied. This service may be useful if you’re looking for a business loan or new line of credit, doing an expansion, embarking on a new partnership or seeking to win a major contract. The CreditMonitor service, available for $39 a month, allows continuous online access to all your credit scores and your credit report, and its changes in real time. You can also pay to see your complete credit report.

#Business credit score check free#

Their free option, the CreditSignal service, provides four credit scores and ratings for 14 days only on its website, and the service will notify you when your business credit score changes.

Then you can choose among D&B’s different subscription tiers. To get a credit score from D&B, you must first apply for a D-U-N-S number.

#Business credit score check how to#

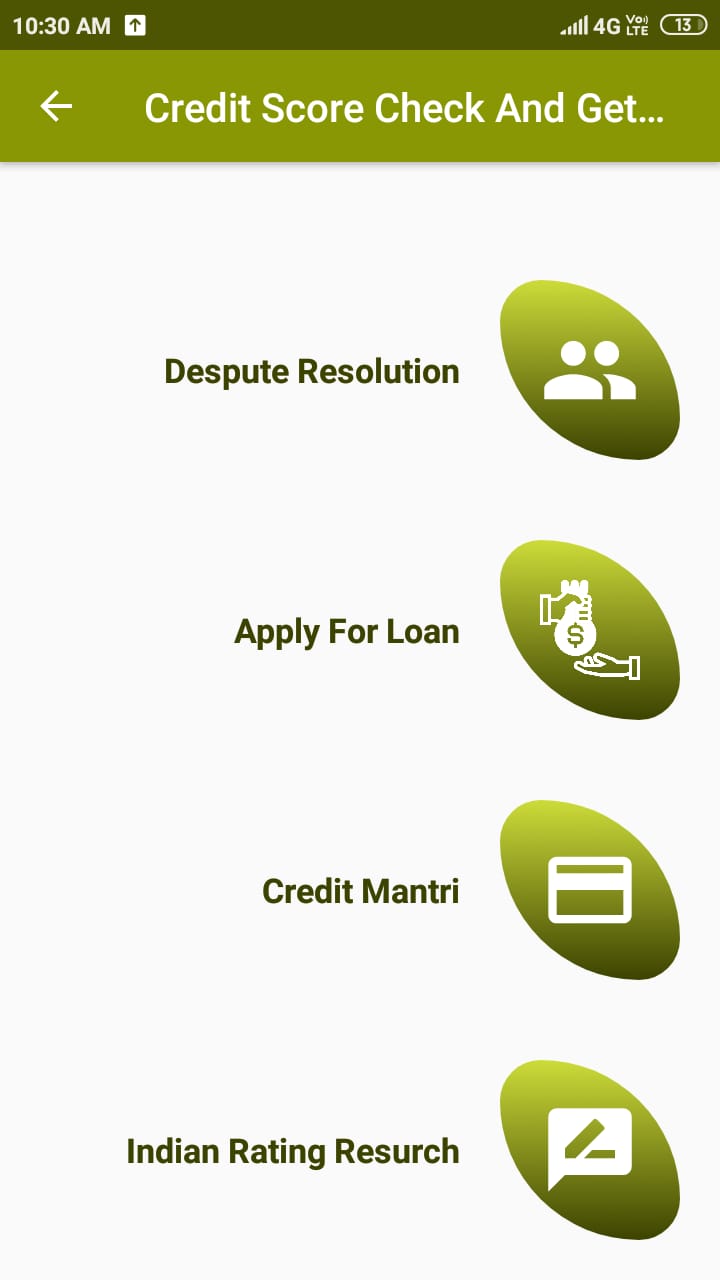

Here’s a crash course on how to check your score with the three major business credit bureaus. If you’re applying for a loan product that’s critical to your business, however, you may want to check all three scores and credit reports. If you want to know your score to gauge its health, checking with one bureau may give you a clear enough idea of your business’s credit profile to operate strategically. Or, if you do have a score, the score you see may not be accurate.Īnother important question to ask yourself is whether you need to check all three credit scores. When your business is still young, it may not even have a credit score yet. Keep in mind that it takes about three years to build a business credit score. Others may only need to check once a year. These businesses may need to subscribe to a service that allows them to do this frequently. Some small businesses that rely heavily on credit may need to check their business credit score frequently to keep track of their progress in building strong business credit to qualify for better interest rates. If your score is too low, it could lead to a rejection.īefore you leap at the opportunity to check your business credit score, do a cost-benefit analysis to determine how important it is to have your score right now and whether spending the money makes sense at the moment. Lease for a commercial property: When applying for a lease of commercial real estate, whether an office building, warehouse, retail space, or something else, the landlord will typically ask you to submit details about your business, including your business credit score.Your business credit score can influence how much time a vendor will give you to pay them. Payment terms with vendors: When conducting business with a vendor, the vendor usually sets the terms of when you have to pay them back, usually between 30 to 90 days.

The higher your business score, the lower your interest rate generally is.

#Business credit score check for free#

Although you can get a personal credit score for free and can usually check it for free at least once a year, there is generally a cost for viewing your business credit score. Knowing where you stand with your business credit score can help you make the most of your credit when you’re applying for loans and business credit cards.īut a business credit score is a little different from a personal credit score, and the process to check it differs, too. If you run a small business, it’s crucial to stay on top of your business credit score.

0 kommentar(er)

0 kommentar(er)